Ensuring equitable compensation is a cornerstone of workforce satisfaction and organizational success. By strategically leveraging business intelligence (BI), companies can analyze and optimize payroll structures to promote fairness. This helps businesses navigate the complexities of compensation to achieve a balanced payroll and motivated working environment.

Let’s explore the various applications of business intelligence to employee wages in this article.

What is fair pay and compensation?

Fair pay and compensation refers to the equitable treatment of employees regarding their wages, benefits, and other forms of compensation within an organization. It involves ensuring that employees receive compensation commensurate with their skills, experience, responsibilities, and contributions to the organization, regardless of gender, race, ethnicity, age, and other protected characteristics.

Benefits of maintaining fair payroll and compensation

Employee satisfaction and morale

Equitable pay and compensation schedules boost employee satisfaction and morale by creating an environment where employees feel valued and recognized. This fosters motivation, engagement, and productivity, contributing to the organization’s overall success.

Retention and employee loyalty

Fair remuneration reduces staff turnover and builds employee loyalty. When employees are paid fairly, they are less likely to look for positions with other companies. A stable, affirming workplace atmosphere encourages long-term commitments, reducing turnover costs and disruptions.

Attracting skilled professionals

Fair pay practices attract top talent, and retaining skilled professionals is crucial for innovation and achieving a competitive advantage. Equitable compensation signals a company’s commitment to fairness and respect for individual contributions.

Enhanced organizational reputation

Fair payroll and compensation practices significantly impact an organization’s reputation, attracting potential employees, customers, and investors. This positive reputation supports business objectives like customer loyalty and brand differentiation.

Diminishing legal exposures

Equitable payroll systems minimize legal risks, protect companies from discrimination allegations, and ensure transparency in compensation practices. This proactive approach safeguards against lawsuits, regulatory penalties, and reputational damage.

Improved financial management

Fair compensation practices benefit employees and organizations by ensuring equitable pay structures and budget alignment. This optimizes resource allocation, prevents overcompensation, and supports business sustainability and growth. Effective compensation management is foundational to strategic financial planning.

Challenges in payroll and compensation

Compliance complexities

Due to diverse labor laws and regulations, companies face many challenges in managing payroll and compensation. Implementing advanced payroll software capable of handling real-time updates and referring to legal experts can help you reduce noncompliance risks and pursue proactive adjustments to payroll processes.

Data accuracy

Inaccurate payroll data causes overpayments, incorrect tax withholdings, and mismanaged benefits, affecting a company’s financial equilibrium. It can also result in violations of labor and tax laws. Integrating HR and payroll systems and conducting regular audits using BI tools can improve accuracy and fortify a company’s financial health as well as its employees’ trust and confidence.

Integration issues

Payroll and accounting systems often struggle to communicate with HR management systems, leading to inefficiencies and errors. To address this, adopting a unified HR software suite, implementing middleware or APIs, and using BI tools are options to facilitate seamless data flow.

Compensation fairness

Ensuring fair compensation across all departments is complex, requiring a balance between market rates, job responsibilities, and individual performance. BI tools can identify pay disparities and guide adjustments, while transparent communication about compensation policies is crucial.

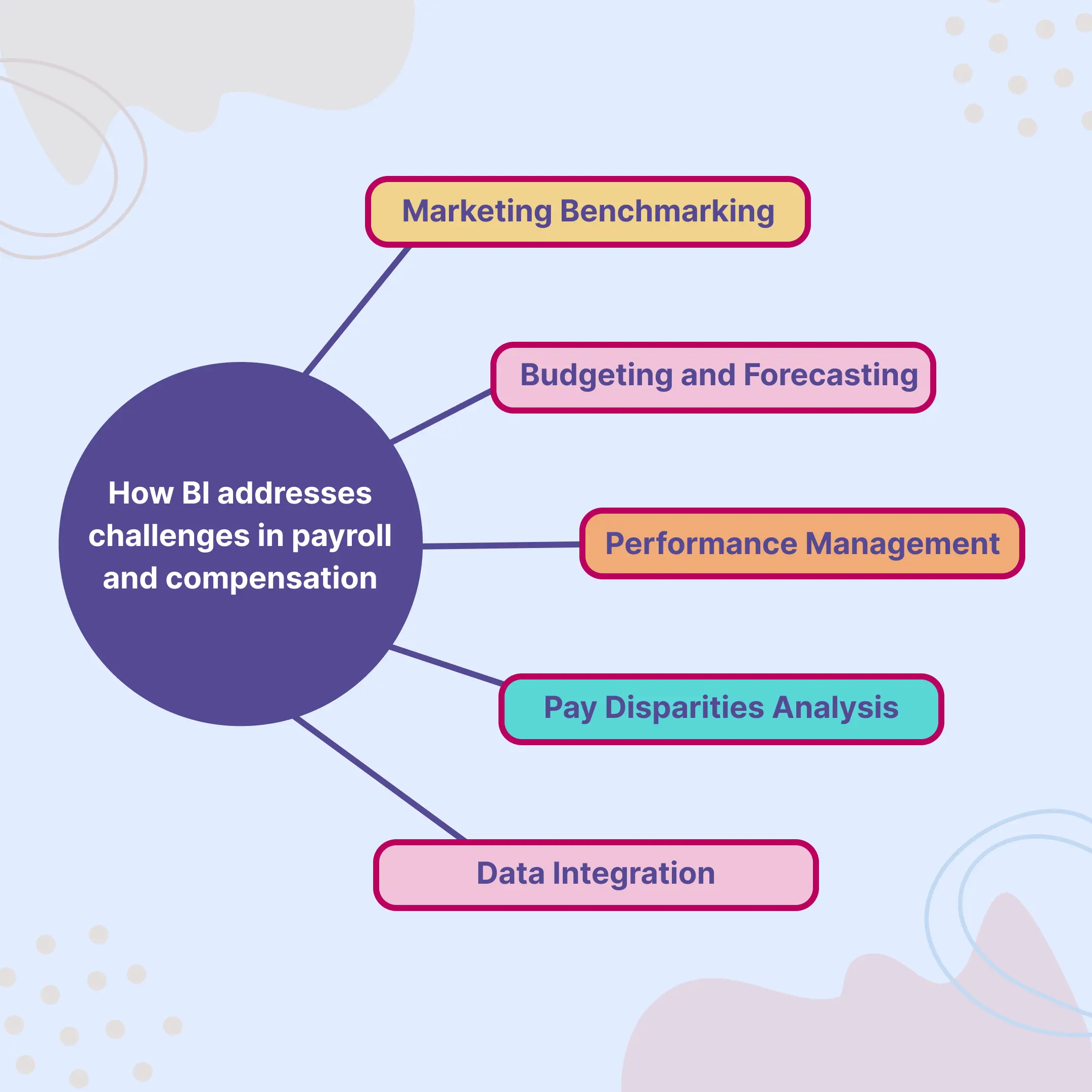

How BI addresses challenges in payroll and compensation

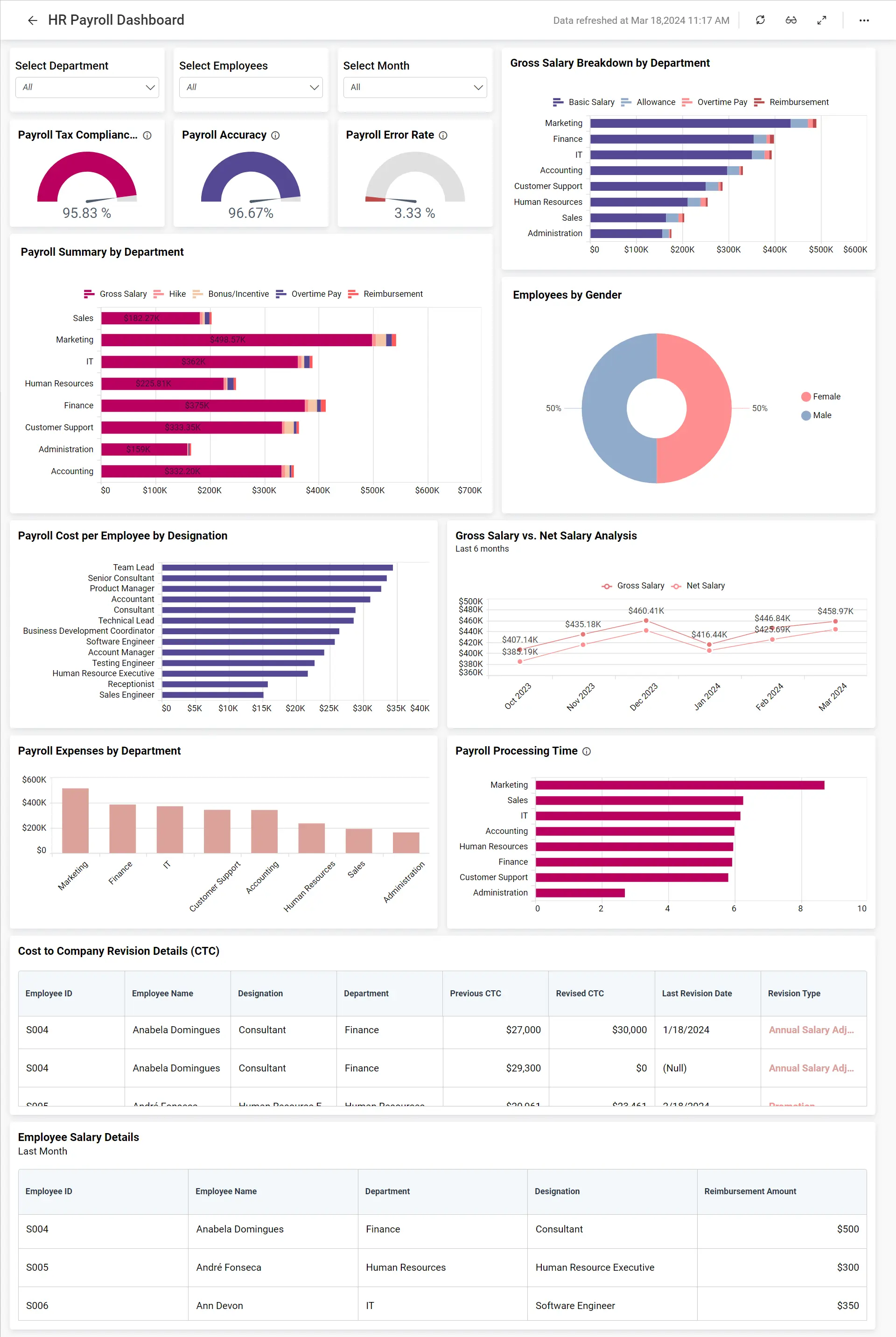

Business intelligence handles the complexities of remuneration management by providing the tools in the following figure to optimize payment structures and employee benefits.

Let’s discuss them in detail.

Data integration

Business intelligence enables seamless integration of data from various sources, like HR systems and payroll software, to provide a unified view of employee information and compensation data.

Pay disparity analysis

BI tools can be used to identify and analyze trends in pay based on factors such as gender and race, allowing organizations to address inequalities and ensure fair compensation practices.

Performance tracking

BI aids companies in establishing precise performance tracking systems by collecting KPIs, aligning pay raises and bonuses with measurable achievements, and ensuring appropriate employee rewards.

Market benchmarking

BI software enables real-time benchmarking against industry pay standards, ensuring organizations maintain competitive compensation structures to attract and retain top talent while fairly paying employees.

Budgeting and forecasting

By evaluating past data, trends, and future estimates, BI enables precise budgeting and forecasting of payroll and compensation costs. This facilitates efficient resource allocation and workforce planning.

Key metrics for monitoring payroll and compensation

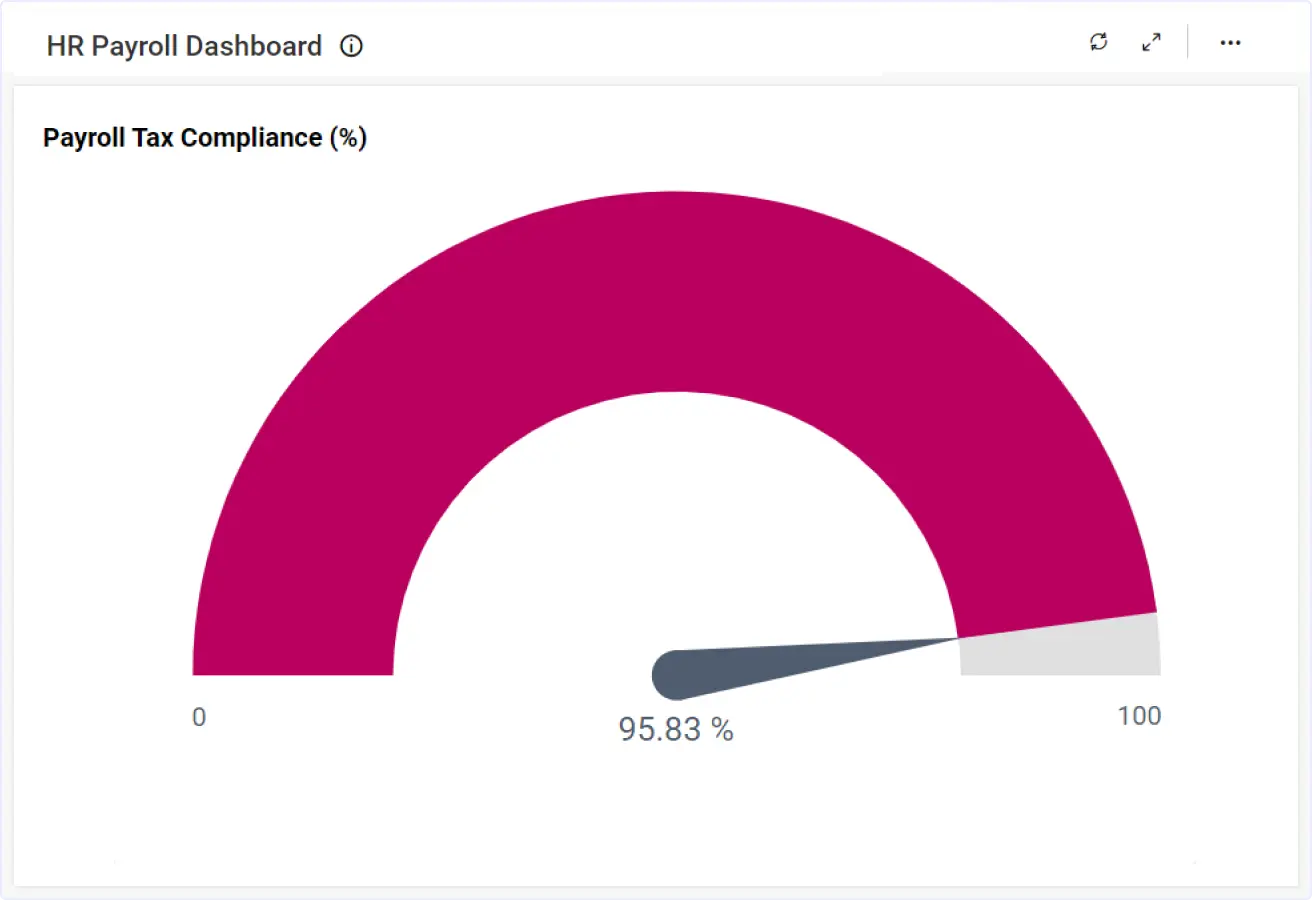

Payroll tax compliance

This metric assesses how well a company complies with payroll tax laws, like correct tax deductions and on-time tax payments. This real-time monitoring also reduces chances of incurring penalties or fines. When this KPI isn’t 100%, accountants can dig into the underlying data and find the offending issue.

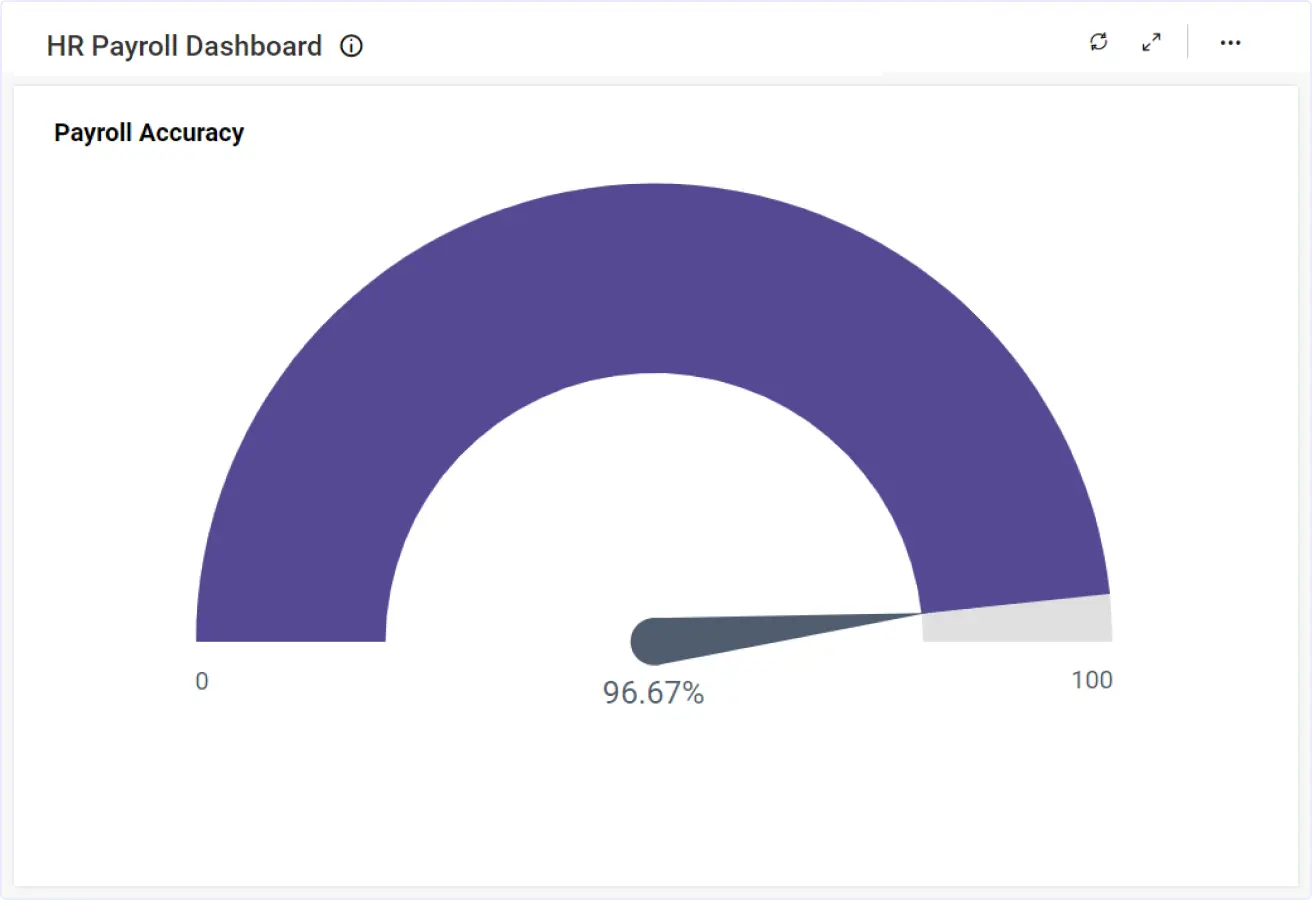

Payroll accuracy

Payroll accuracy is the accuracy of employee compensation, including salaries, bonuses, and deductions, and it is monitored in real time. When accuracy is less than 100%, the finance department can investigate, identify, and rectify issues, thereby ensuring employee trust and satisfaction.

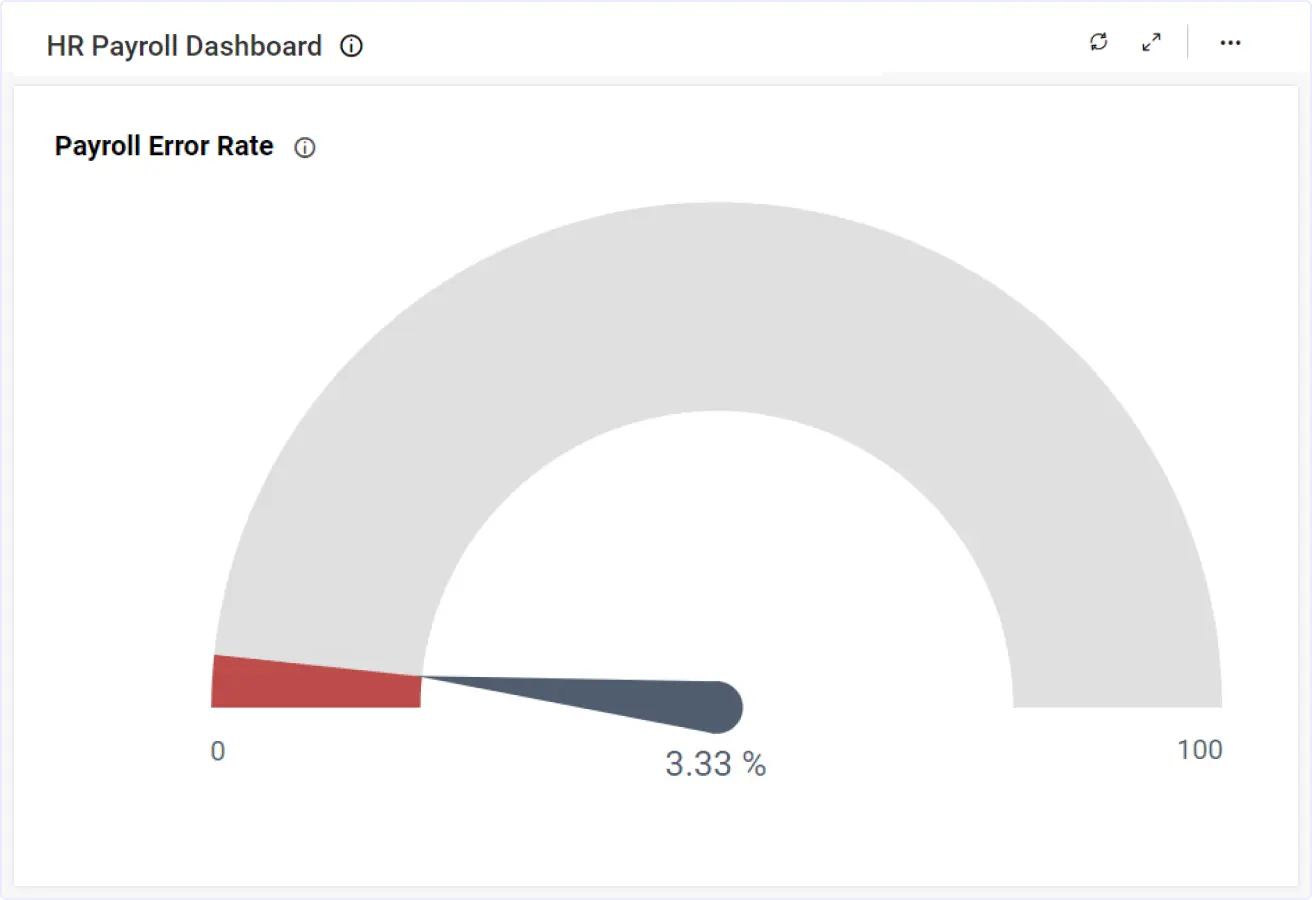

Payroll error rate

The payroll error rate measures the percentage of payroll transactions with errors, such as incorrect calculations or missed payments. This real-time monitoring helps prevent financial losses and legal repercussions.

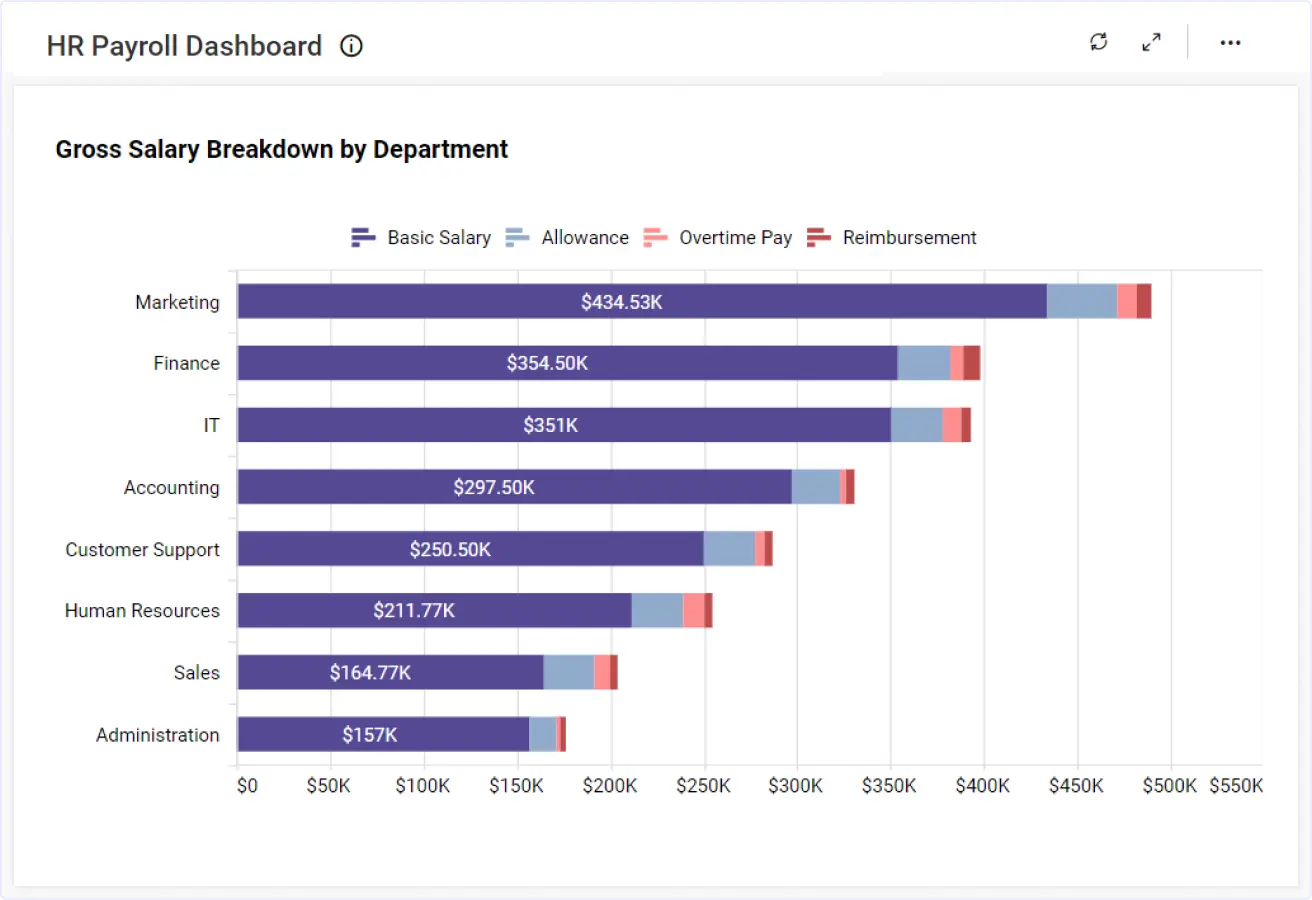

Gross salary breakdown by department

The metric evaluates employee salary distribution across departments, assessing payroll efficiency and equity. It aids in budgeting, resource allocation, and performance evaluation decisions, enabling companies to make adjustments to better allocate employee pay and make better compensation decisions for the long term.

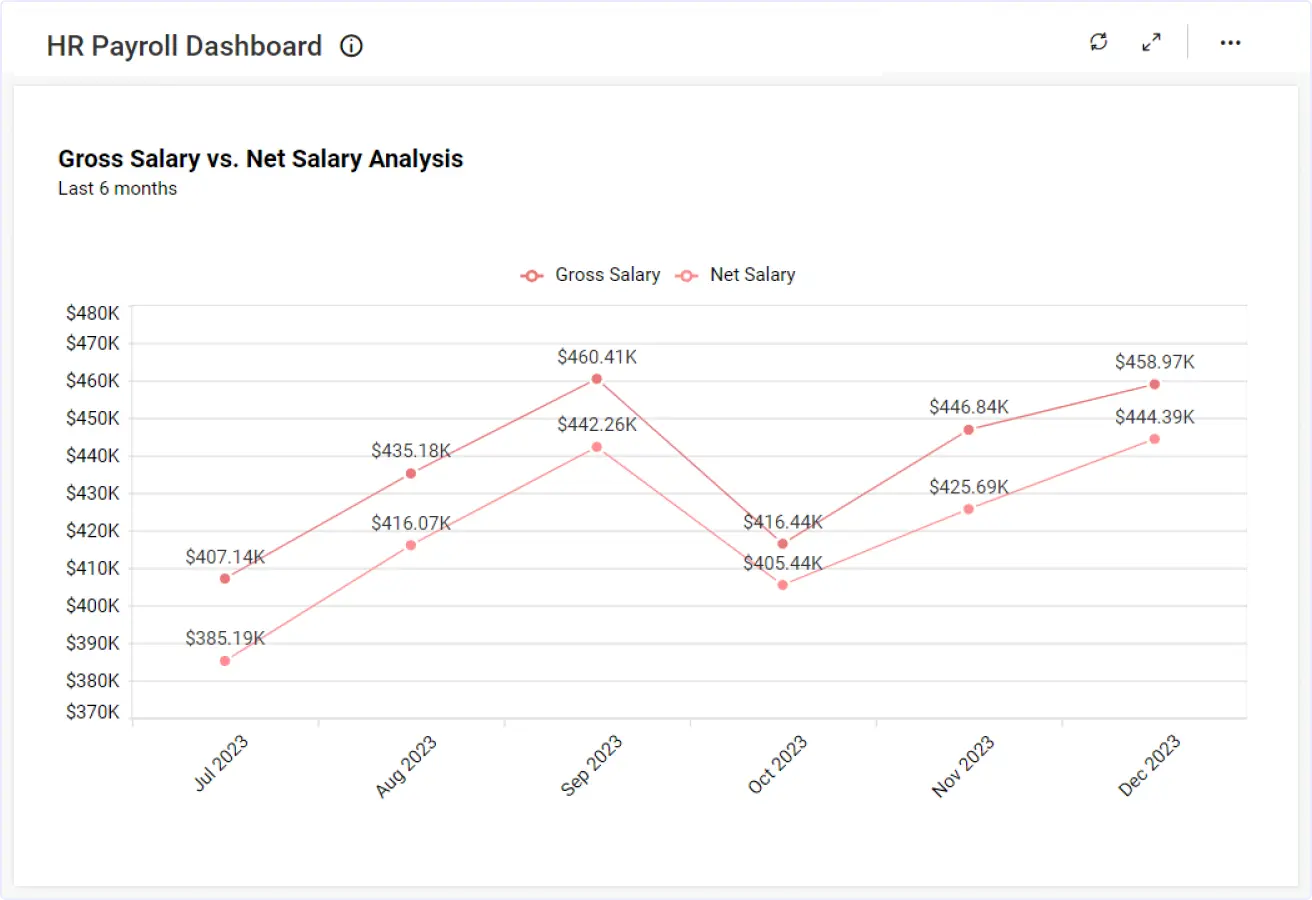

Gross salary vs. net salary analysis

This analysis compares the gross and net salaries of employees, accounting for the impact of taxes, benefits, and deductions on earnings. Keeping an eye on this data allows organizations to keep gross compensation balanced with benefits packages for employee satisfaction and retention.

How to choose the right BI tool for payroll and compensation analysis

Selecting a BI tool to analyze your payroll and compensation arrangements involves careful consideration of its capability to integrate data, deliver real-time analytics, and adapt to meet your specific needs. Prioritize solutions that offer built-in (or let you easily design) payroll and compensation metrics, scalability to grow with your organization, and user-friendly interfaces designed for effective payroll management. Discover essential strategies for choosing a BI tool that aligns with your organization’s objectives in our guide, 8 Tips for Choosing the Right BI Tool.

For HR, accounting, and payroll professionals, a BI dashboard is a crucial tool for making informed decisions. It simplifies complex payroll and compensation data into clear visualizations, enabling rapid analysis and easier strategic planning.

Start Embedding Powerful Analytics

Try out all the features of Bold BI with 30-day free trial.

By harnessing BI tools, you can gain valuable insight into pay structures, ensuring fairness and alignment with both employee expectations and organizational objectives. Take proactive steps to integrate BI into your payroll workflows today. Empower your workforce, enhance transparency, and drive organizational success.

If you have any questions or need assistance, don’t hesitate to reach out through the Bold BI website; simply log in to submit your inquiries if you already have an account. If you’re not yet a customer, get started with Bold BI now by signing up for a free trial!